Reply From Senator Udall

Dear Dana,

Thank you for contacting me with your thoughts regarding overdraft fee policy. I appreciate you taking the time to share your concerns on this issue.

As you know, Senator Chris Dodd introduced the FAIR Overdraft Coverage Act (S.1799). This bill would make changes to the law with regard to overdraft fees and penalties in an effort to increase transparency and consumer fairness. The FAIR Overdraft Coverage Act has been referred to the Senate Committee on Banking, Housing, and Urban Affairs for review. More recently, the Federal Reserve issued new rules that prohibit financial institutions from charging overdraft fees on automated teller machine(ATM) and one-time debit card transactions, unless the consumer consents, or opts in, to the overdraft service for those types of transactions. Under the rules, which will take effect on July 1, 2010, before opting in, the consumer must be provided with a notice that explains the financial institution’s overdraft services, including the fees associated with the service and the consumer’s choices.

I hate to see Coloradans who have unknowingly overdrawn funds hit with excessive fees, especially when so many hard-working Americans are already struggling to make ends meet. While I believe that all consumers have a personal responsibility to handle their own finances, I also believe there should be fairness with regard to the issue of overdrawing funds, which is why I welcome the Federal Reserve’s new rules. I will continue to work with my colleagues of both parties to end abusive practices by financial institutions and level the playing field for American consumers.

Again, thank you for contacting me. In these hard economic times, please be assured that I will continue to keep the economic interests of Coloradans at the top of my policy agenda.

I will continue to listen closely to what you and other Coloradans have to say about matters before Congress, the concerns of our communities, and the issues facing Colorado and the nation. My job is not about merely supporting or opposing legislation; it is also about bridging the divide that has paralyzed our nation’s politics. For more information about my positions and to learn how my office can assist you, please visit my website at www.markudall.senate.gov.

Warm Regards,

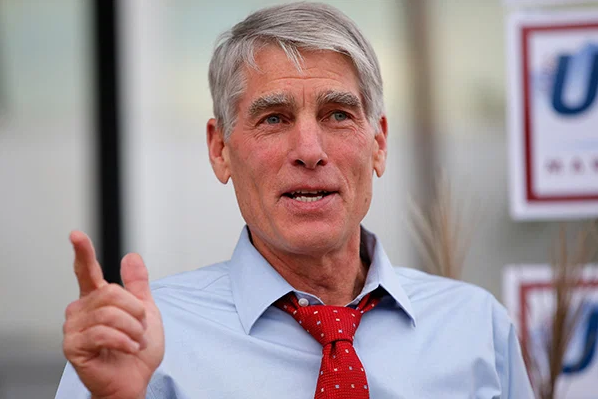

Mark Udall

United States Senator, Colorado

Advertisement

In other words… no.

I suppose we will have to accept Senator Dodd's bill as impetus to force the Fed to do something about these usuristic overdraft "protection programs," a feature which, unless required by the Fed, Wells Fargo would not permit me to remove myself from.

Therefore I believe we need to ensure we start a campaign of public relations, educating the average American consumer to ensure they are unenrolled from the feature that will cost them $18 billion, while we wait for the requirement date of the Fed's ruling.

In the meantime, with $62 in the bank, a storage space auto-payment of $44 scheduled to come out any day, and a $5 check oput to cover my daughter's new student ID, I will have little choice but to give Wells Fargo 120% APR interest against the Direct Deposit advance they conveniently offer right from their web site, to help me avoid the astronomical APR of the fees that will be charged should my $13 pad be unexpected used up.